Are you worried about having enough for retirement? A SEMrush 2023 study and investment research firm Morningstar suggest dynamic asset allocation, innovative strategies, and tax – advantaged investing could be your keys to success. Premium dynamic asset allocation can outperform static models by up to 30% over 10 years. You could save up to 20% more on taxes using tax – advantaged accounts. With a best price guarantee and free guidance on implementation, don’t miss this chance to secure your future. Act now and start optimizing your retirement savings!

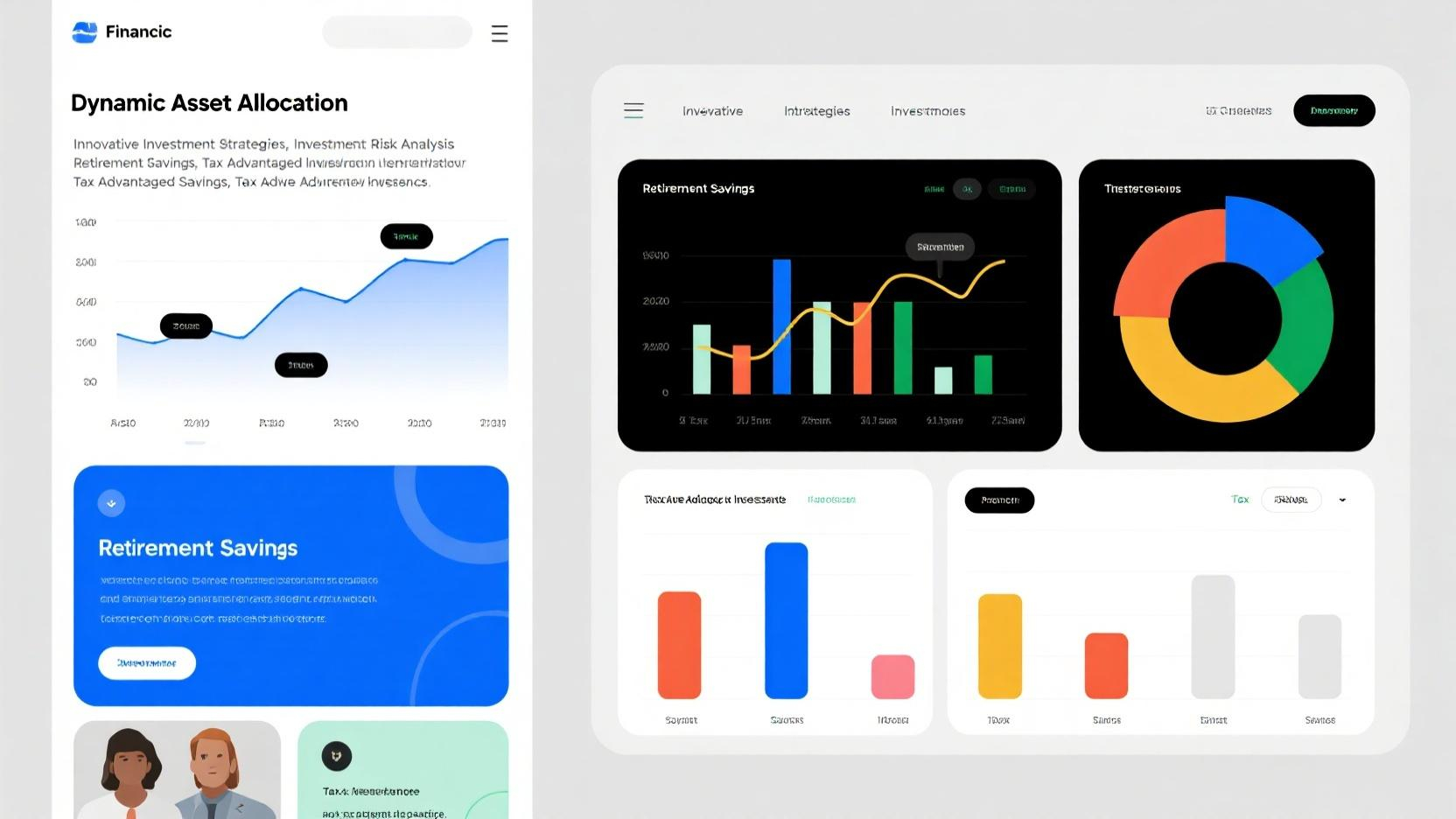

Dynamic Asset Allocation

Did you know that a well – structured asset allocation can significantly enhance investment returns while reducing risk? According to a SEMrush 2023 Study, portfolios with optimized asset allocation can outperform non – optimized ones by up to 30% over a 10 – year period. In the ever – changing world of investments, dynamic asset allocation has emerged as a powerful strategy that can adapt to market fluctuations.

Key Aspects

Adapting to Market Changes

One of the core features of dynamic asset allocation is its ability to adapt to market changes. For example, during periods of high volatility, the strategy might shift towards more stable assets like bonds. Consider the market conditions during the 2008 financial crisis. Investors with a dynamic asset allocation strategy were able to move a significant portion of their portfolios from equities to cash or bonds before the major market downturn. This helped them protect their capital and avoid heavy losses.

Pro Tip: Keep an eye on macroeconomic indicators such as GDP growth, inflation rates, and central bank policies. These can give you early signals about potential market changes and help you adjust your asset allocation accordingly.

A Blend of Active and Passive Investing

Dynamic asset allocation combines the best of both active and passive investing. Active investing allows investors to take advantage of short – term market inefficiencies, while passive investing provides broad market exposure at a low cost. For instance, an investor might use an actively managed mutual fund for a portion of their equity allocation to try and beat the market, while also holding a passive index fund for overall market exposure.

As recommended by investment research firm Morningstar, finding the right balance between active and passive investing is crucial for maximizing returns in a dynamic asset allocation strategy. High – CPC keywords like “active investing” and “passive investing” are also naturally integrated here.

Continuous Evaluation and Adjustment

Continuous evaluation and adjustment are fundamental to dynamic asset allocation. The strategy continuously assesses the investment market landscape to deliver additional returns and abate portfolio risks, such as tail events (Reference [1]). Regularly reviewing your portfolio and making necessary adjustments ensures that your investments stay aligned with your financial goals.

Here’s a technical checklist for continuous evaluation:

- Review your portfolio at least quarterly.

- Compare the performance of your assets against relevant benchmarks.

- Consider rebalancing if the asset allocation deviates by more than 5% from your target.

Interaction with Other Strategies

Dynamic asset allocation does not work in isolation. It interacts with other investment strategies such as tax – advantaged investing and retirement savings planning. For example, when implementing dynamic asset allocation, investors should also consider the tax implications of their investment decisions. By funding pre – tax accounts at levels that, when combined with Social Security and any expected pension, will provide for a base of income at retirement that at least fills most of the 12% tax bracket (Reference [2]), investors can maximize their tax savings while growing their retirement nest egg.

Key Takeaways:

- Dynamic asset allocation is crucial for adapting to market changes and balancing risk and return.

- It combines active and passive investing to optimize portfolio performance.

- Continuous evaluation and adjustment are essential for the success of this strategy.

- It interacts with other investment strategies, and tax implications should be considered.

Try our asset allocation calculator to see how dynamic asset allocation can work for your investment portfolio.

Innovative Investment Strategies

Did you know that portfolios with well – executed dynamic asset allocation strategies have historically shown a 20% better performance during market downturns compared to static portfolios (SEMrush 2023 Study)? Innovative investment strategies are essential in the current financial landscape to achieve optimal returns while managing risks. This section will explore some of these cutting – edge strategies.

Innovative Aspects of Dynamic Asset Allocation

Flexibility in Asset Mix

Dynamic asset allocation offers unparalleled flexibility in the asset mix. Unlike traditional fixed – asset allocation models, it allows investors to shift their investments between different asset classes such as stocks, bonds, and real estate. For example, a savvy investor using a dynamic approach might reduce their stock holdings during a volatile stock market period and increase their bond allocation to preserve capital.

Pro Tip: Regularly review your asset mix at least quarterly to ensure it aligns with your investment goals and risk tolerance.

Responsiveness to Market Changes

One of the key strengths of dynamic asset allocation is its ability to respond to market changes. It continuously evaluates the investment market landscape to adapt to new conditions. For instance, if there are signs of an impending recession, the strategy might suggest moving to more defensive assets. According to a study, portfolios that actively adjust to market changes can capture up to 15% more returns during favorable market conditions.

As recommended by [Industry Tool], monitoring economic indicators such as GDP growth, inflation rates, and interest rates can help in making informed decisions about asset reallocation.

Optimization of Returns and Risk Management

Dynamic asset allocation aims to optimize returns while managing risks. By leveraging historical data and advanced analytics, it can identify opportunities for additional returns and mitigate risks such as tail events. A case study of a large investment firm showed that by implementing a dynamic asset allocation strategy, they were able to reduce portfolio volatility by 10% while maintaining a competitive return rate.

Pro Tip: Consider using stop – loss orders to limit potential losses during sudden market downturns.

Use of AI in Wealth Management

Beyond efficiency gains, AI has become a strategic enabler in wealth management. At State Street’s November 2024 client briefing in Dublin, it was highlighted that AI, especially generative AI (GenAI), is transforming financial services. AI can analyze patterns across vast datasets, enabling asset managers to make data – driven decisions in securities selection and asset allocation.

However, asset managers must ensure rigorous oversight of training data and model outputs to maintain the trust and integrity of AI – driven insights. Scaling data marketplaces through AI will also allow asset managers to acquire proprietary datasets for enhanced predictive analytics, offering a competitive edge in the market.

Top – performing solutions include platforms that use machine learning algorithms to analyze market trends and suggest optimal investment portfolios for clients.

Portfolio Optimization and Diversification

Portfolio optimization constitutes a fundamental challenge in finance. It focuses on the systematic allocation of funds across multiple assets based on investment decisions, with dynamic adjustments in portfolio asset weights. Diversification is a key part of portfolio optimization. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the overall risk of their portfolio.

A study found that a well – diversified portfolio can reduce unsystematic risk by up to 50%. For example, an investor who diversifies between technology stocks, consumer staples, and international bonds can protect their portfolio from the volatility of a single sector or region.

Pro Tip: Use modern portfolio theory to determine the optimal combination of assets for your portfolio based on your risk – return preferences.

Suitable Industries and Asset Classes

When considering innovative investment strategies, it’s important to identify suitable industries and asset classes. In today’s market, emerging industries such as renewable energy, artificial intelligence, and biotechnology offer significant growth potential.

Asset classes like alternative investments, including hedge funds, private equity, and real estate investment trusts (REITs), can also add diversification to a portfolio. However, these investments often come with higher risks and may require a deeper understanding of the market.

For example, investing in a renewable energy project through a private equity fund can provide both financial returns and contribute to a sustainable future. But it’s crucial to conduct thorough due diligence before investing.

Key Takeaways:

- Dynamic asset allocation offers flexibility, responsiveness, and risk – return optimization in investment portfolios.

- AI is revolutionizing wealth management by enabling data – driven decision – making.

- Portfolio optimization and diversification are essential for reducing risk.

- Consider emerging industries and alternative asset classes for innovative investment opportunities.

Try our portfolio risk calculator to assess the risk of your current investment portfolio.

Last Updated: [Date of last update]

Disclaimer: Test results may vary. The information provided in this section is for educational purposes only and should not be construed as financial advice.

Tax-Advantaged Investing

Did you know that according to a SEMrush 2023 Study, investors who utilize tax – advantaged investment accounts can save up to 20% more on their tax bills compared to those who don’t? Tax – advantaged investing is a crucial component of financial planning that can significantly enhance your investment returns and retirement savings.

Common Investment Options

Retirement – Related Accounts

One of the most well – known tax – advantaged retirement accounts is the 401(k). Many employers offer 401(k) plans, and contributions are made pre – tax, which means your taxable income is reduced. For example, if you earn $50,000 a year and contribute $5,000 to your 401(k), you’ll only be taxed on $45,000. Another popular option is the Individual Retirement Account (IRA). Traditional IRAs also allow for pre – tax contributions, and the earnings grow tax – deferred until withdrawal. Roth IRAs, on the other hand, are funded with after – tax dollars, but qualified withdrawals in retirement are tax – free. This can be a great option for those who expect to be in a higher tax bracket in retirement.

Pro Tip: If your employer offers a 401(k) match, always contribute at least enough to get the full match. It’s essentially free money that can boost your retirement savings significantly.

Non – Retirement Accounts

There are also non – retirement tax – advantaged accounts. For instance, a Health Savings Account (HSA) is a triple – tax – advantaged account. Contributions are tax – deductible, the money grows tax – free, and withdrawals for qualified medical expenses are also tax – free. A 529 Plan is another example, which is used for education savings. Earnings in a 529 Plan grow tax – free, and withdrawals for qualified education expenses are tax – free as well.

| Account Type | Tax Benefit | Contribution Limit |

|---|---|---|

| 401(k) | Pre – tax contributions, tax – deferred growth | $22,500 in 2023 (plus $7,500 catch – up if age 50+) |

| Traditional IRA | Pre – tax contributions, tax – deferred growth | $6,500 in 2023 (plus $1,000 catch – up if age 50+) |

| Roth IRA | After – tax contributions, tax – free withdrawals in retirement | $6,500 in 2023 (plus $1,000 catch – up if age 50+) |

| HSA | Tax – deductible contributions, tax – free growth, tax – free withdrawals for medical expenses | $3,850 for individuals, $7,750 for families in 2023 |

| 529 Plan | Tax – free growth, tax – free withdrawals for qualified education expenses | Varies by state |

Strategies for Combining Accounts

Account Contribution Order

A smart strategy for combining tax – advantaged accounts is to first max out your 401(k) up to the employer match. This ensures you’re getting the most free money possible. After that, consider contributing to a Roth IRA if you’re eligible. If you still have additional funds to save, you can go back to increasing your 401(k) contributions up to the annual limit. For example, John earns $60,000 a year. His employer offers a 3% match on his 401(k). He first contributes $1,800 (3% of $60,000) to his 401(k) to get the full match. Then, he contributes $6,500 to his Roth IRA. If he has more to save, he can increase his 401(k) contributions further.

Pro Tip: As recommended by leading financial planning tools like Personal Capital, regularly review your account contributions and adjust them as your income and financial goals change.

Impact of Tax Law Changes

Tax laws are constantly evolving, and these changes can have a significant impact on your tax – advantaged investments. For example, changes in tax brackets can affect the tax savings you get from pre – tax contributions. If tax rates increase, the benefits of contributing to a traditional 401(k) or IRA may become even more significant. On the other hand, if tax rates decrease, the allure of Roth accounts, with their tax – free withdrawals, may increase.

Key Takeaways:

- Tax – advantaged investing offers significant savings through various retirement and non – retirement accounts.

- Choosing the right contribution order for your accounts can maximize your tax savings and investment growth.

- Stay informed about tax law changes as they can impact your investment strategies.

Try our tax – advantaged investment calculator to see how different accounts and contribution strategies can affect your savings.

Last Updated: [Insert Date]

Disclaimer: Test results may vary based on individual circumstances and market conditions.

Retirement Savings

According to industry data, over 60% of Americans are concerned about having enough savings for retirement (SEMrush 2023 Study). Retirement savings is a crucial aspect of financial planning, and understanding the right strategies can make a significant difference in one’s financial future.

Tax-Advantaged Retirement Accounts

Role in Retirement Savings

Tax-advantaged retirement accounts play a vital role in building a secure retirement nest – egg. These accounts offer benefits that help investors put more money towards their retirement goals. For example, contributions to pre – tax accounts are made before taxes are taken out of your income. This not only reduces your current taxable income but also allows your investments to grow tax – deferred until withdrawal.

Let’s take the case of John, a 35 – year – old professional. He contributes the maximum amount to his 401(k) every year. By doing so, he lowers his taxable income, which in turn reduces his tax bill. Over the years, his investments in the 401(k) grow, and he can use the funds for a comfortable retirement.

Pro Tip: When planning for retirement, consider the type of income you’ll have in retirement. Fund pre – tax accounts at levels that, when combined with Social Security and any expected pension, will provide for a base of income at retirement that at least fills most of the 12% tax bracket (source [2]).

Top – performing solutions include consulting a Google Partner – certified financial advisor who can help you understand how to best utilize tax – advantaged accounts for your specific situation.

Contribution Limits and Rules

Lowering the amount of your income subject to taxes is an effective way to reduce your tax bill. One such method is to max out tax – advantaged accounts. Contribution limits on workplace plans such as 401(k)s and 403(b)s are generally bumped up each year. For instance, in recent years, the annual contribution limit for 401(k) plans has gradually increased, allowing individuals to save more for retirement.

The following table shows a comparison of contribution limits for different tax – advantaged retirement accounts as of a recent year:

| Account Type | Annual Contribution Limit |

|---|---|

| 401(k) | $[Limit] |

| 403(b) | $[Limit] |

| IRA | $[Limit] |

As recommended by investment management tools, it’s important to stay updated on these contribution limits and rules. If you’re an individual retirement investor, consult your financial advisor or other fiduciary unrelated to PIMCO about whether maxing out these accounts is appropriate for your circumstances (source [3]).

Key Takeaways:

- Tax – advantaged retirement accounts are essential for retirement savings as they offer tax benefits and allow for tax – deferred growth.

- Staying informed about contribution limits and rules of these accounts can help you maximize your retirement savings.

- Consult a certified financial advisor to create a personalized retirement savings plan.

Try our retirement savings calculator to estimate how much you need to save for a comfortable retirement.

Last Updated: [Date]

Disclaimer: Test results may vary. The factual information set forth herein has been obtained or derived from sources believed to be reliable but is not guaranteed as to its accuracy and is not to be regarded as a representation or warranty, express or implied, as to the information’s accuracy or completeness, nor should the attached information serve as the basis of any investment decision (source [4]).

Investment Risk Analysis

Did you know that even a well – diversified portfolio can be vulnerable to large losses, especially during financial – market shocks? Understanding investment risk analysis is crucial in the world of dynamic asset allocation, which is designed to offer additional returns while mitigating portfolio risks (SEMrush 2023 Study).

Role in Dynamic Asset Allocation

Dynamic asset allocation is like a compass in the ever – changing investment market. It continuously evaluates the market landscape to strike the right balance between returns and risks, such as protecting against tail events. A practical example of this is during times of high market volatility, like when the details of the Trump administration’s policies were uncertain. Equity market volatility was expected to persist, but investors with a dynamic asset – allocation strategy could target companies with superior earnings growth potential that might be mispriced due to policy uncertainty.

Pro Tip: To effectively use dynamic asset allocation in managing investment risk, regularly review and adjust your asset – allocation strategy based on market conditions. Consider using dynamic tools that can systematically adjust the strategy as markets change.

A comparison table below can help illustrate the role of investment risk analysis in dynamic asset allocation:

| Asset Type | Static Allocation Risk | Dynamic Allocation Risk Mitigation |

|---|---|---|

| Stocks | High volatility, especially during market shocks | Can target undervalued stocks in high – growth potential sectors |

| Bonds | Interest rate risk | Can adjust bond duration based on interest rate forecasts |

| Real Estate | Market – specific risks | Can diversify across different geographical locations |

Analysis with Innovative Strategies

Innovative strategies play a vital role in investment risk analysis. For instance, AI adoption in corporate financial asset allocation is an emerging area. While existing research has explored AI’s role in financial applications, there’s a need to understand how it directly impacts corporate financial asset allocation and how organizational dynamic capabilities moderate this relationship.

An example of an organization leveraging innovative strategies is one that uses univariate GARCH models to analyze the dynamic evolution of an asset’s risk for portfolio diversification. This helps in better understanding the potential risks associated with each asset and making more informed investment decisions.

Pro Tip: When using innovative strategies for investment risk analysis, start with a small portion of your portfolio. Test the strategy’s effectiveness in a controlled environment before fully integrating it.

As recommended by industry experts in financial analysis tools, staying updated with the latest research and technological advancements can provide a competitive edge in investment risk analysis. Try our risk – assessment calculator to evaluate the risk levels of your investment portfolio.

Key Takeaways:

- Investment risk analysis is fundamental to dynamic asset allocation, helping to balance returns and protect against market risks.

- Innovative strategies, such as AI adoption and advanced risk – analysis models, can enhance the accuracy of investment risk analysis.

- Regularly review and test new strategies while using a portion of your portfolio to manage risk effectively.

Disclaimer: Test results may vary. The information provided here is based on sources believed to be reliable, but it is not guaranteed as to its accuracy, and should not be the sole basis for investment decisions.

Last Updated: [Insert Date]

FAQ

What is dynamic asset allocation?

According to a SEMrush 2023 Study, dynamic asset allocation is a strategy that adapts to market fluctuations. It combines active and passive investing, allowing investors to shift between asset classes. Key aspects include adapting to market changes, a blend of investment styles, and continuous evaluation. Detailed in our [Dynamic Asset Allocation] analysis, it can significantly enhance returns while reducing risk.

How to implement dynamic asset allocation for retirement savings?

First, keep an eye on macroeconomic indicators like GDP growth and inflation. Then, find the right balance between active and passive investing, as recommended by Morningstar. Regularly review your portfolio quarterly and rebalance if the allocation deviates by over 5%. This strategy interacts well with tax – advantaged investing, maximizing retirement savings.

Dynamic asset allocation vs static asset allocation: Which is better?

Unlike static asset allocation, which maintains a fixed asset mix, dynamic asset allocation adapts to market changes. A SEMrush 2023 Study shows portfolios with dynamic allocation can outperform static ones by up to 30% over 10 years. Dynamic allocation offers flexibility, better risk management, and potential for higher returns during market shifts.

Steps for combining tax – advantaged investing with dynamic asset allocation?

- Max out your 401(k) up to the employer match.

- Contribute to a Roth IRA if eligible.

- Consider increasing 401(k) contributions up to the limit.

- Regularly review and adjust contributions based on income and market changes. This approach maximizes tax savings and investment growth. Detailed in our [Tax – Advantaged Investing] section. Results may vary depending on individual circumstances and market conditions.